Written on

February 18, 2010 by

admin in

News

Insurance tips, traps for home-owners who open their homes to foreigners

Renting out assets to World Cup tourists will probably affect the owner’s insurance, BJM Insurance Brokers said on Tuesday.

“Failure to disclose a material change to your insurer could invalidate your cover, while proper disclosure may lead to increased premiums,” BJM said in a statement.

Insurance cover most likely to be affected included household contents, buildings, vehicles and public liability.

“Insurance protects you under a certain set of circumstances.

“When circumstances change so should your insurance,” BJM said.

Letting and hiring out insured assets constituted a material change in circumstances.

Cover for house contents insured the owner and family members not tenants and their belongings.

Read the full article at:

http://www.realestateweb.co.za/

Written on

February 17, 2010 by

admin in

News

Find the artists – they spot bargains just before prices move up.

Let the ‘trendies’ show you the way, says Chas Everitt International CEO Berry Everitt.

With interest rates low and economic prospects looking better, the number of first-time buyers is rising again. But most are still looking for “bargains” and in this respect they might want to take a tip from best-selling author and motivational speaker Harvey Mackay (Swim with the sharks without being eaten alive).

Read the full article at:

http://www.realestateweb.co.za

Written on

February 12, 2010 by

admin in

News

South Africa is the best performing housing market in the world over the longer term, latest figures from British news magazine The Economist reveal.

The magazine’s global house price index shows that SA house prices rose by a cumulative 418% over the past 12 years (1997 to 2009).

Continue Reading »

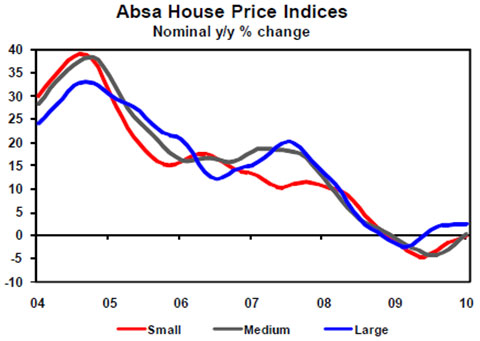

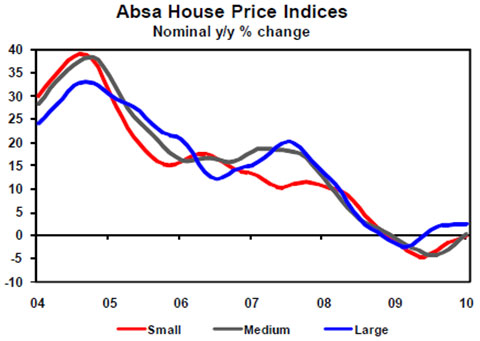

Large houses have shown the greatest resilience in the face of South Africa’s first recession in over a decade, according to data released on Monday.

According to Absa’s House Price Index the average large house (221m2 to 400m2) lost 3.7% of its price in December 2009, compared to the same period in 2008. Small- and medium-sized homes lost 6.6% and 6.9% of their value respectively, compared with December 2008.

Continue Reading »

The home buying process and especially your home loan, is a long-term commitment and not something you do every day. You need to be correctly informed before making any decisions. It is always a good thing if you can put some money towards a deposit for your new home, but Standard Bank have some options available for those of you who don’t have the deposit available. The deposit is usually 20% of the cost of your home.

Continue Reading »

A Mortgage Originator is a person who acts on your behalf when you apply for a home loan.

When you visit a bank directly, they tend to be very biased toward their own products and services offered. When you make use of an originator, you will receive more independent advice.

Continue Reading »

A Mortgage Originator is a person who acts on your behalf when you apply for a home loan. This person will offer you professional advice regarding mortgages and are less biased towards a specific bank.

Mortgage originators receive commission from the banks directly, and they usually do not cost you anything at all.

The home loan industry is constantly changing keeping it almost impossible for the common person to keep up with interest rates, terms, home loan options, and the many choices for home loan providers. Employing the services of a mortgage originator can greatly increase your chances of getting the best deal.

Continue Reading »

On a bond of R400 000 at an interest rate of 10.5% paid over 20 years, your total finance charges would be R592 765.

A 1% cut in your interest rate would result in R525 257.80 finance charges, or a saving of R67508 (11.3%).

Continue Reading »

Although buying a home can be a demanding process, selling a home has its own set of challenges. Sellers must understand from the beginning there is only one chance to make a first impression with each potential home buyer.

Continue Reading »